The Impact of Cloned Cards on the Business Landscape

In today’s digital era, the intersection of technology and commerce has given rise to numerous innovations and challenges. One of the pressing challenges that businesses face is the issue of cloned cards. These fraudulent instruments not only pose risks to financial institutions but also to businesses and consumers alike. This article delves into the intricacies of cloned cards, their implications for the business sector, and effective strategies to manage the risks they present.

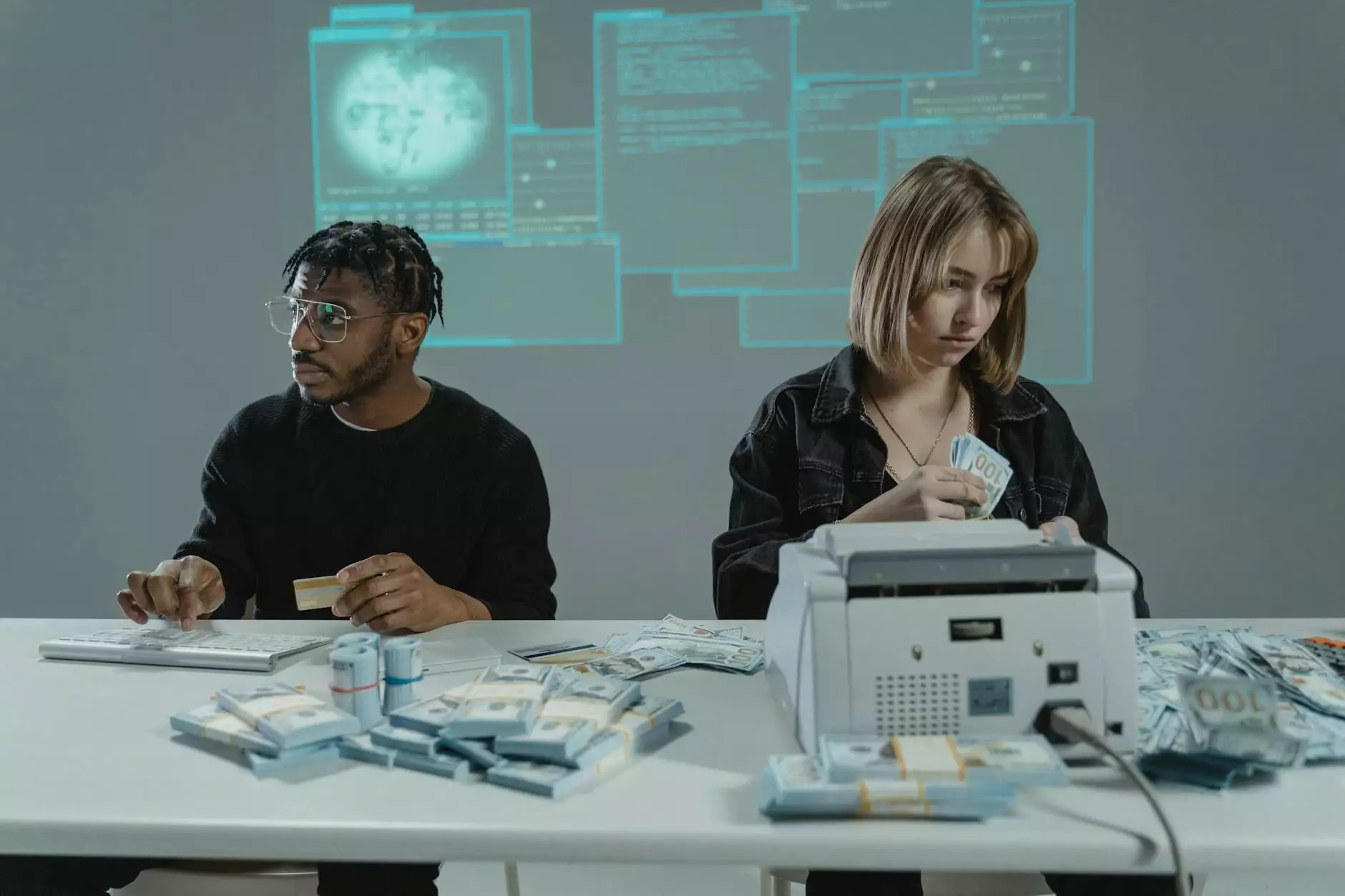

Understanding Cloned Cards

Cloned cards are counterfeit versions of legitimate credit or debit cards created through illegal means. The process typically involves obtaining sensitive information such as the card number, expiration date, and CVV from unsuspecting cardholders. This data is then used to produce a duplicate card that can be exploited for financial gain without the knowledge of the original card owner.

How Cloning Occurs

The cloning of cards can occur through various tactics, including:

- Data Skimming: Fraudsters install devices on ATMs or point-of-sale terminals that capture card data when a legitimate card is used.

- Phishing Scams: Unsuspecting consumers may inadvertently provide their card details through fake websites or emails pretending to be legitimate entities.

- Malware Attacks: Cybercriminals can exploit vulnerabilities in software or apps to harvest sensitive payment information from users.

- Physical Theft: Stolen cards can also be duplicated using a simple cloning machine by capturing the magnetic strip data.

The Business Impact of Cloned Cards

For businesses, the ramifications of cloned cards go beyond direct financial losses. The implications stretch into various facets of operations:

Financial Losses

The most immediate impact relates to financial losses that can occur when businesses are held accountable for fraudulent transactions. When a cloned card is used for a purchase, the financial institution may seek reimbursement from the merchant, leading to:

- Loss of revenue from chargebacks

- Increased transaction fees

- Potential penalties for insufficient fraud prevention measures

Customer Trust and Brand Reputation

Consumer trust is paramount in any business. If customers believe that their payment information is not secure, they may choose to take their business elsewhere. The potential fallout includes:

- Negative reviews and feedback

- Loss of repeat customers

- Long-term damage to brand reputation

Legal and Compliance Issues

Businesses are also subject to a range of legal obligations to protect consumer data. Failure to comply with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) can result in:

- Substantial fines and legal actions

- Increased scrutiny from regulatory agencies

- Mandatory audits and compliance checks

Mitigating the Risks of Cloned Cards

To effectively combat the challenges posed by cloned cards, businesses must adopt a proactive approach. Here are several strategies that can be implemented:

1. Strengthening Security Protocols

Investing in robust security systems is critical. Businesses should:

- Utilize end-to-end encryption for transactions to protect sensitive data.

- Implement tokenization technology to reduce the exposure of card details.

- Regularly update systems and software to defend against malware and vulnerabilities.

2. Employee Training and Awareness

Employees are often the first line of defense against fraud. Conducting regular training can help staff recognize potential threats, understand the risks, and adhere to best practices in data protection.

3. Employing Advanced Fraud Detection Tools

Utilizing AI and machine learning-based tools can enhance transaction monitoring. These technologies can identify unusual patterns and flag potentially fraudulent transactions in real time.

4. Enhancing Customer Awareness

Educating customers about the importance of safeguarding their data can create an additional layer of protection. Businesses can provide:

- Information on recognizing phishing attempts

- Guidelines for secure online shopping practices

- Advice on using credit monitoring services

The Future of Business in the Age of Cloned Cards

As technology continues to evolve, so too does the landscape of fraud. The emergence of digital currencies, contactless payments, and blockchain technologies are reshaping how we think about transactions and security. While these innovations bring numerous benefits, they also present new challenges.

The Role of Regulation

Regulatory bodies play a crucial role in establishing robust frameworks to combat fraud. As the financial sector navigates the complexities introduced by new technologies, it will become increasingly essential for regulations to adapt accordingly. Stakeholders must advocate for:

- Stricter compliance requirements

- Collaboration between businesses and law enforcement agencies

- Investment in innovative security solutions

Conclusion

The emergence of cloned cards has significant implications for the global business landscape. Businesses must stay vigilant, adopting a multifaceted approach to cybersecurity and fraud prevention. By prioritizing security, investing in employee training, and educating customers, organizations can not only protect themselves from financial losses but also preserve their reputation and maintain consumer trust.

Call to Action

As digital transactions continue to rise, it is essential for all businesses to take action now. Evaluate your current security measures, enhance employee training programs, and prioritize consumer education to effectively combat the threat of cloned cards. Visit premiumbills.org for more resources and solutions tailored to your business needs.